For this shortened week I wanted to try something different. Instead of a longer-form piece I consolidated some of my conflicting thoughts around the economy (& other stuff) right now in the style of Adam Tooze’s famous CHARTBOOK. The idea for CHARTBOOK is to collect a bunch of charts, images, and insights in a free-form manner to try and suss out larger connections and themes, so without further ado…DRAFTBOOK

This chart really took me by surprise — how could it be that people feel a 55-point difference between their own situation and that of the economy as a whole? I think the best comparison point has to be pre-COVID in 2019 where the delta was only 25-points, so that’s essentially doubled? And personal finances have maintained in the mid-70s?

This feels odd — either there’s some shame about admitting your own financial health (similar to the 2016 Trump-polling effect); or people are just too online and think everything is terrible.

The Wheel. Less of a chart and more of service online that has very 2008-recession vibes. I remember growing up during the GFC and there were a lot of scam-ish ideas out there. One I firmly remember was the Penny Auction Sites (see: DealDash); the gimmick being you could win an XBOX for $8.36, but each bid (at $0.01 a bid) cost you $0.60 to buy…so $4.36 of bids actually equaled $501.60 of income for the site. The Wheel is different, but preys on the same “too good to be true” / “fun gambling” vibe that the Penny Auctions did. Feels like a recession indicator but maybe it’s just an extension of the explosion in sports gambling and the normalization of gambling as a whole…

Is the Republican party in serious trouble? I’ve been very skeptical of the takes you see floating around online about how liberal Gen Z / Millennials are. Generations get more conservative as they age (case in point) — but this drop off in donor support is shocking…

See that? At the time of writing (5/24) there was a nearly 500 bps delta between Treasuries maturing end of May 31st and June 15th. 500 bps of return for 15 days of risk…whatever could be the cause of that?

Proof that using the debt ceiling and the threat of default as a bargaining chip is reckless and materially impactful on the U.S. economy and the government’s ability to continue to finance itself1.

The next chart is combining the Michigan Consumer Sentiment index (solid Blue/Grey/Red) versus their GFC lows (dotted Blue/Red) and Unemployment and Consumer Price Inflation (black). The call-out I wanted to raise is that for the past nearly…2 years? Republicans have felt that the economy was worse than the Global Financial Crisis. I can understand the impact that inflation had (and continues to) have on people, but this seems unproductively partisan.

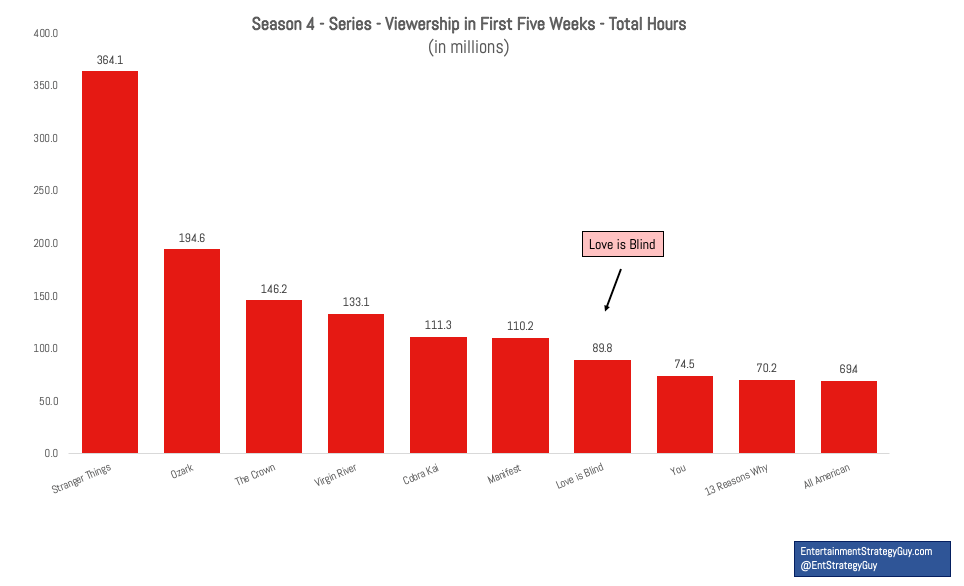

Love is Blind is a massive success for Netflix. I’m not typically a big reality TV guy (although Survivor is an addiction) — but clearly, I’m in the minority. Few shows even make it to Season 4 on Netflix anymore (I didn’t even know 13RW did…) and to see such success from reality TV has me reconsidering my prior disgust with the HBO Max + Discovery move. The name change? Dumb. But the content increase? We will see.

God, have we become a society of losers? Or rather — are people so financially sound that losing is a more acceptable outcome and people are net/net gambling more?

Working in the loop 3 — 4 days a week this is not a surprising stat (never hard to get a seat on a Monday or Friday) and it does ~vibe~. Loop classics like CERES are having last calls earlier and earlier. I have no stats here but there do seem to be more storefronts that have “available” signs than 2019. Is this due to a general economic downturn? Domination of e-Commerce? COVID? Probably COVID, but it’s certainly a downer to walk by all the empty shops.

A Dril classic reborn.

Cruises, a typical marker of a frothy economy are now packed “like sardines” reflecting an eager populus who want to vacation.

When the talking heads on TV speak about job openings a lot of that chatter is with respect to either (i) the headline number, or (ii) the everyday interactions people have that seem to be working less smoothly due to staffing shortages. This is primarily the Leisure & Hospitality sector, which as you can see is the major loser of the post-pandemic economy. But don’t ignore the second biggest loser, Education & Health. I don’t have a fix for education, but it sure feels like we’re creating a climate where a field already underappreciated is now being attacked, doesn’t seem like a good idea…

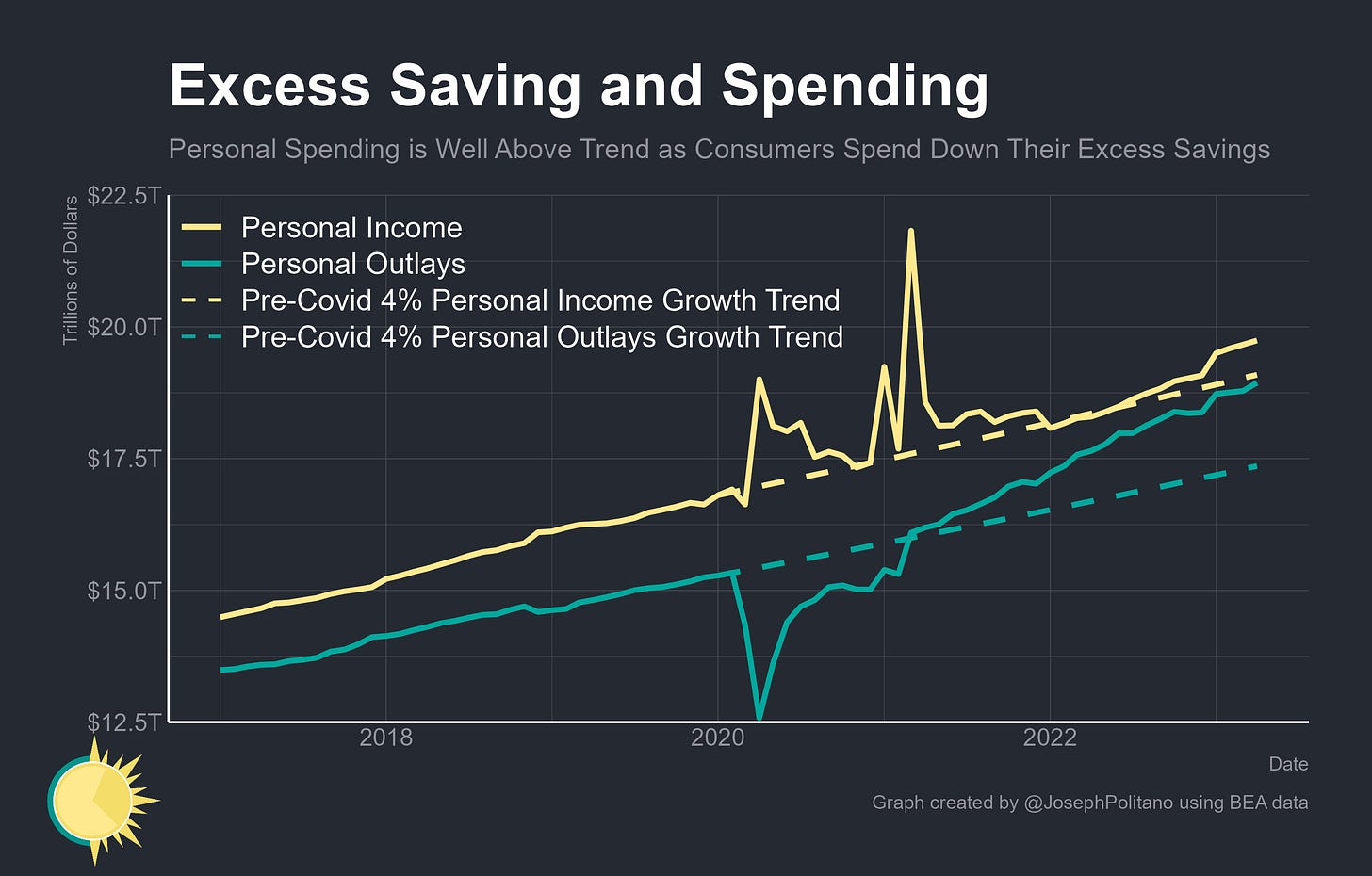

Joey Politano is an ex-BLS analyst who now runs the Substack Apricitas Economics. There’s some really good info in his most recent post on Americans’ Excess Savings and how this shows the economy is finally going to start slowing down. The above chart shows how we’ve been spending and earning relative to the pre-pandemic trajectory. I think combined with the prior charts we can start to decern some conclusions, so let’s.

The economy is weird right now.

I think it’s extra weird for us young-millennials / old Gen-Zers. We’re entering the workforce and have received the bulk of the Pandemic government benefits (student loan stoppage, checks) since we’re fresh out of school, but our earnings potential has also increased through non-state functions like pay increases on the job. In addition to that, few in this age range have lots of required spending (kids, major health expenses, etc…) increasing the individual propensity to spend…. but I got side-tracked.

People are earning more in nominal terms than ever before, and for low-to-middle income individuals that number is up on a real basis. This growth in dollar figure we see in our paychecks is a real and can impact the way we feel about our personal situation regardless of if that number is actually less due to reduction in purchasing power (inflation). This is especially true because people are buying more than they were before, and I think a reasonable measure of how folks are doing (especially in a time of moderate inflation) is how much they can buy. If people are still buying the goods they need, but also splurging on non-durable and durable goods they want they’ll think the economy is just fine for them.

Consider this — a person who racked up savings during the long-Pandemic (March 2020 — June 20222) has received a few salary increases via job-switching or promotion in that 2020 — present period. Those increases have gone toward covering the increasing costs of everything. Food, entertainment, decor, etc…

But those savings have been allowing for the trips, accessories, drinks, that make it feel like things are great, not just good. This same person, who’s aggregate spending is above what it was in 2019 is feeling good about their situation and is aware that others might not have saved like them.

I think that’s the gist of the story, savings vs. spending. We assume the worst in others and think we’re in the best position. The truth is somewhere in the middle.

The Debt Ceiling crisis appears to be in the clear, but the point still stands, this is no way to negotiate.

I choose this as the date because this is when you didn’t have to wear masks on Public Transit here in Chicago. I get in less-urban areas things got back to normal earlier, but this is my personal metric.