import tax arguments

A lot of pixels have been spilled on the topic of the Trump Tariffs, or the Trump Import Tax Hike, and I am unfortunately going to add to the pile. Since the free fall in the market began last Thursday, I’ve been glued to Twitter trying to get a sense for what arguments people are making, and in the real world I’ve been listening (and generally not responding) to how people are thinking about this crash — this isn’t necessarily a Bargument guide, but I’m going to try and front run some of the most common arguments from real life people (not internet trolls) and how I counter them in a way that is reasonable productive. Even though the markets rallied today (April 9, 2025) its still important to push back on the ideas being presented by this administration, because they are at best incoherent and worst malicious.

Lower interest rates (with an emphasis on housing).

A lot of folks in my age cohort are concerned about affording a house; that is a very valid concern. The root of this argument is that (i) the stock market crashes, and (ii) the Federal Reserve in an effort to keep the market afloat lowers interest rates resulting in lower interest rates on mortgages, which are correlated with the 10-year U.S. treasury.

This…makes sense if you imagine yourself to have loads of cash in 2008 and were able to perfectly time the market, which is how everyone imagines themselves. Especially growing up with The Big Short and Margin Call, the amount of people who think they can predict the next crash, and its bottom, is staggering. I hate to break it to you, Chad, but if the vast amounts of sophisticated financial institutions out there can’t beat the market…neither can you.

Every 27 — 35-year-old is waiting for the perfect storm of low interest rates, low housing prices, high personal savings amount, and all localized in their preferred market…but these things are connected.

The truth is that we were living in a bit of a goldilocks era post-2008 and that is unlikely to repeat itself. If rates decrease you need to ask, why. They’re lowering rates because economic output is declining…which means unemployment, which means you or someone you know might lose their job. How are you supposed to afford a home regardless of the interest rate if you don’t have a job?

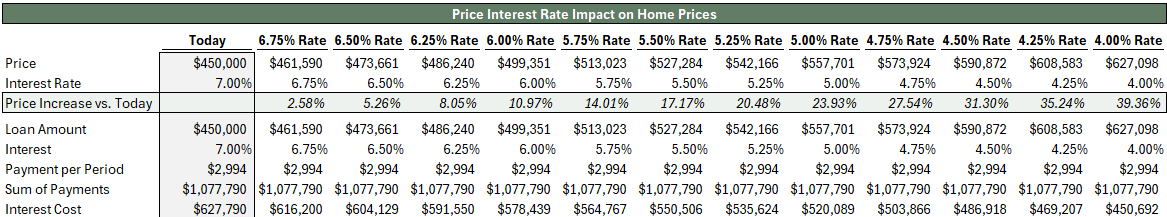

There’s also the simple math of the equation. How much house you can buy is a derivative of your monthly payment, which includes both interest and principal payments. If you can afford a $2,900 monthly payment — that doesn’t equal the same home price if rates drop. Here’s a quick summary of how much “home” a $2,900 monthly payment could afford you based on interest rate movements:

In this very simplistic analysis if rates dropped from 7% to 4% — the same monthly payment would be able to afford a house that is 40% more expensive…so how do those “savings” get distributed?

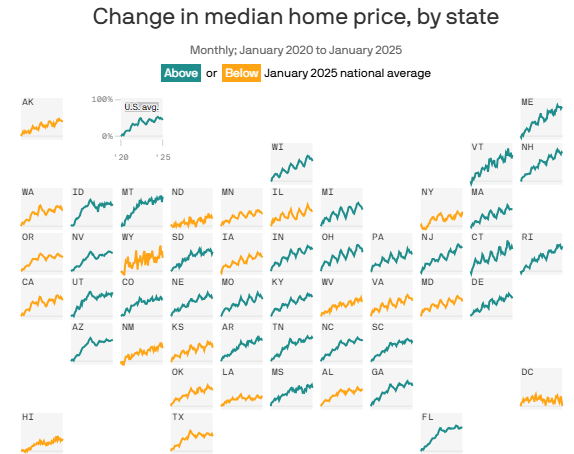

Is it the buyer who is able to buy more home? Or is it the seller who is able to ask for more money? For guidance I’d look to the 2020 - 2025 period where the median home price increased 44.6% nationally with pretty much every state increasing by more than 40%.

This speaks to a fundamental supply issue which has not changed and is not being addressed by Trump administration policies. I would expect the same dynamic to play out if rates again declined resulting in higher returns for homeowners, and higher costs for home buyers.

Key counter argument: Think of home prices as a variable on monthly payment vs. pure rates calculation. Everyone wants rates to decline, do you think you’re the only millennial who’s hoping to buy once rates drop? If 2008 was such a great time to buy homes why were unemployment and homelessness rates so high?

Reshoring global supply chains.

I think there is an argument for targeted import taxes to encourage domestic manufacturing. But if you genuinely believe that import taxes which are implemented in such a manner that “shotgun approach” is too conservative of an idiom is the right approach…we need to ask what we are trying to do.

To what ends are we trying to re-industrialize the U.S.? Is there something that inherently makes working 8-hour shifts making electrical components for iPhones better than a customer service or retail job? Genuinely! I know that a lot of folks wax nostalgic about the great times where people were able to feed a family of eight on one income, but that’s a cost-of-living problem not a jobs issue. Making Nikes in America won’t result in the return of single income households, and neither will more service jobs. Trying to bring simple manufacturing back to the U.S. is a means, and there is not a coherent link between the imposed taxes and better living standards for Americans.

The Trump administration’s lack of focus is evident. The reasons behind these import taxes changes by the day and their devotion to ending Biden administration efforts like the bipartisan CHIPS and Science Act and the Inflation Reduction Act, both of which have funds to reshore strategically important industries (e.g., batteries, semiconductors) — noble goals which would seem to align with Trump thesis on reshoring…but alas. Owning the libs appears to be a more important goal than owning international supply chains.

Key counter argument: Why is the Trump administration imposing tariffs on non-key industries like apparel while reducing the efforts to re-shore important industries like semiconductors and batteries? Why do we want a country where we make t-shirts instead of software?

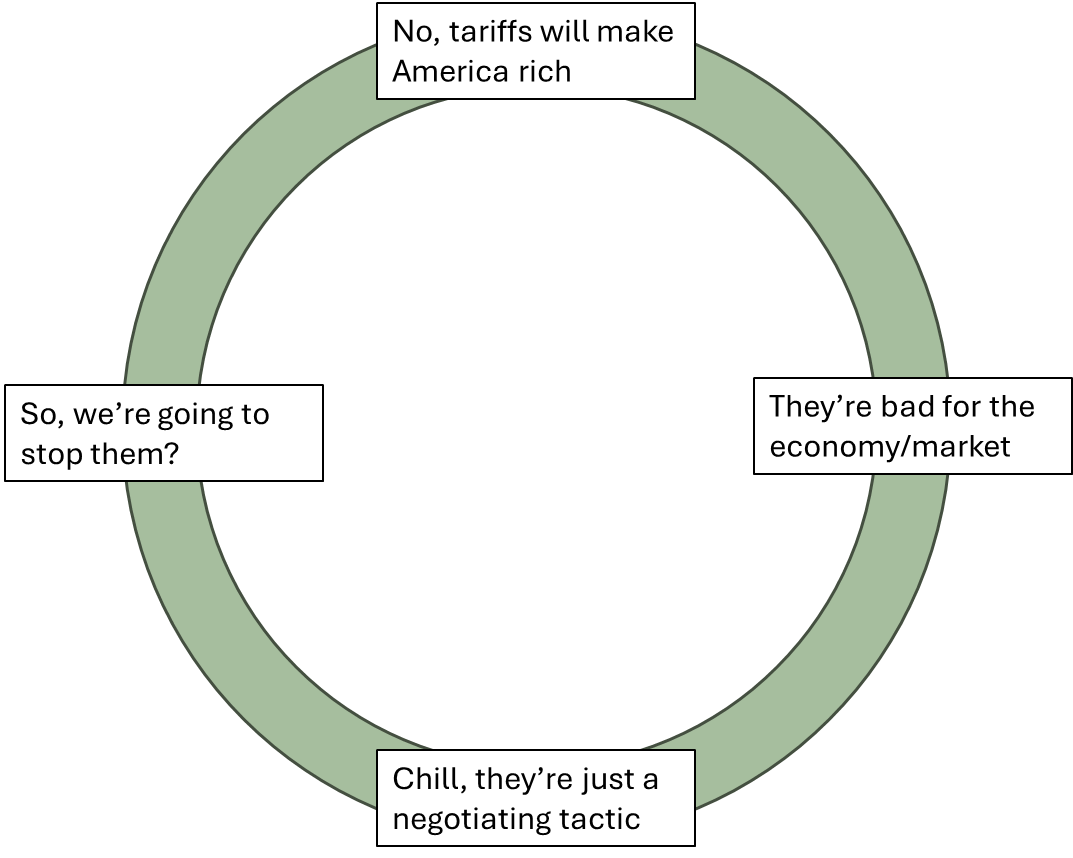

Negotiating.

Some people, and real-world people not just Twitter avatars, will argue that this is just a negotiating stance. Why of course, President Trump is just playing the market off itself and outsmarting everyone!

But negotiating is merely a means — if someone claims that this Trump Tax Hike is a negotiating tactic then one has to ask — to what ends?

Does he want more domestic production? If so, what kind and refer to the above argument.

Does he want lower rates? If so, for what purpose and refer to the above argument.

Does he want America to increase income via import taxes, then are they really a negotiating tactic if they’re supposed to stay in place?

This whole “Trump plays 4-D chess” take is starting to erode in the public consciousness and that’s a good thing, but it is still worth being ready to counter those ridiculous arguments.

Key counter argument: What are we negotiating for?

National debt restructuring.

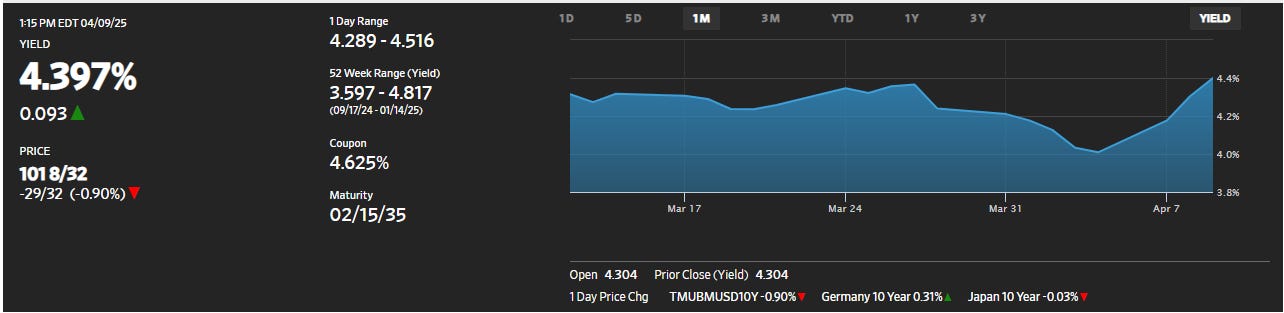

The last argument I haven’t heard in the real world; but I think it’s worth engaging with. The idea is that crashing the market will bring down U.S. treasury rates and then the U.S. will renegotiate a large swathe of its outstanding bonds such that the borrowing cost, and the country’s yearly spend on interest, decreases materially.

At its core, lowering the interest burden of the country is a good idea. But they’re missing a key point here. The U.S. treasury rate decreases when times are bad because there is demand for U.S. assets. If there is less demand for U.S. financial assets because, I don’t know, the U.S. is trying to remove itself from the international trading system, then the demand for U.S. T-bills declines…and rates increase.

Just look at this 1-month chart…demand for U.S. bonds are declining folks…this is not good. Faith in the U.S. combined with the informal status a global reserve currency has provided massive benefits over the years and Trump is finding out in real time what happens when we break that trust.

Key counter argument: The 10-year rate is increasing as a result of these tax hikes. It could be due to a variety of factors which include (i) liquidation to cover trades (because the market is tanking), or (ii) a flight away from the U.S. — both of which are a result of the actions taken. If we want to decrease long-term rates, negatively shocking the system does not seem to be working and is highly risky.

Look, Trump is an idiot. That is not a novel take, but the market’s reaction is making it clear for even the doubters. You do not need to be a neoliberal to believe that the market reactions transmit valuable information, and man is it telling us something. If democrats are lucky, the Trump Tariff narrative will chip away at the trust the public has given republicans on economic issues for the past decade, but at a deep human cost.

So, words of warning — do not root for hardship. We live in an economy where the last in are often the first out. It is not the rich who will hurt the most when the stock market crashes. Do not root for degrowth. Growth is good and more innovation and production are worthy goals to root for. Don’t get bogged down in every little wiggle in the S&P 500; the trend is what matters, and the trend is bad.

Good luck to everyone, I hope someone stands up to the President, and soon. Maybe congress, or business leaders, or the deep state, or the shadowy cabal that runs the New World Order. Somebody, please.