okay fine, inflation

Today is April 23 and Joe Biden’s approval rating is…bad.

The President’s job is massive in scope so it would make sense that the job performance rating is based a variety of performance objectives — which one could (and I won’t) argue Biden is failing at. With that said, let’s put aside our diverse opinions on issues like Afghanistan, Build Back Better, infrastructure spending, and Hunter Biden’s laptop and focus on what people are really mad about today: inflation.

Where to begin, where to begin. Over the past 12 months or so I’ve written up a few pieces on inflation but they have remained in my drafts folder due to my feeling that they were incomplete — but now that inflation seems to be driving the normie debate at bars and get-together, I felt it was time to outline some thoughts to help guide my thinking and hopefully convince those around me how to think about the economic environment we’re in, and how it is informing my decisions about the future (including who to vote for in 2022). Because let’s be honest — no one’s just looking for an opinion on why prices are rising — they’re really looking for someone (or something) to blame.

So — who’s (what’s) to blame here?

Since 2021 I’ve been on “Team Transitory”. Transitory was a word that came to dominate monetary policy circles and used as shorthand for the view that inflation was driven by the supply-chain (and other) disruptions caused by the COVID-19 pandemic, and would not be permanent. The simple explanation that I use to visualize this framework:

If congestion at ports leads to higher shipping costs, that shipping cost is often passed on to you. Because that congestion at ports is due to COVID-driven disruptions, as the traffic eases so will the costs that consumers pay.

So we’re not in for wage-push inflation, or demand-push inflation, it’s transitory, supply-chain driven inflation. That is manageable, that will ease over time. And importantly, that is not the fault of U.S. policy makers (Trump, or Biden).

Now, us on Team Transitory have been raked over the coals over the past few months as the Fed formally retired the term, but even the WSJ Opinion Section agrees with me. In December 2021 Alan Blinder wrote for the Wall Street Journal about how the inflation debate was going, and how some economists were framing it incorrectly, he wrote:

The old aphorism that inflation arises from “too much money chasing too few goods” is close, but “too much demand chasing too little supply” is spot on.”

Mr. Blinder correctly frames the issue as demand (which has been spectacular coming out of a recession) vs. supply, not money (which people read as a result of the 2020 and 2021 stimulus packages) vs. goods. Those of us[1] who have read a lot about the Global Financial Crisis of ‘07 — ‘09 understand that a key failure was the lack of investment coming out of the recession. It lead to sub-par growth for years following the crisis and some of the persistent issues that lead to a general malaise during the twenty-tens. The large fiscal transfers not only kept those on the edge of despair afloat for a few months — it also prevented a a larger crisis from brewing by maintaining credit available for all consumers. We learned the lessons of the GFC and acted on it — in a unique bi-partisan matter. Can you imagine the Tea Party endorsing trillion dollar stimulus packages during the fallout ‘08 fallout? Yeah…neither can I.

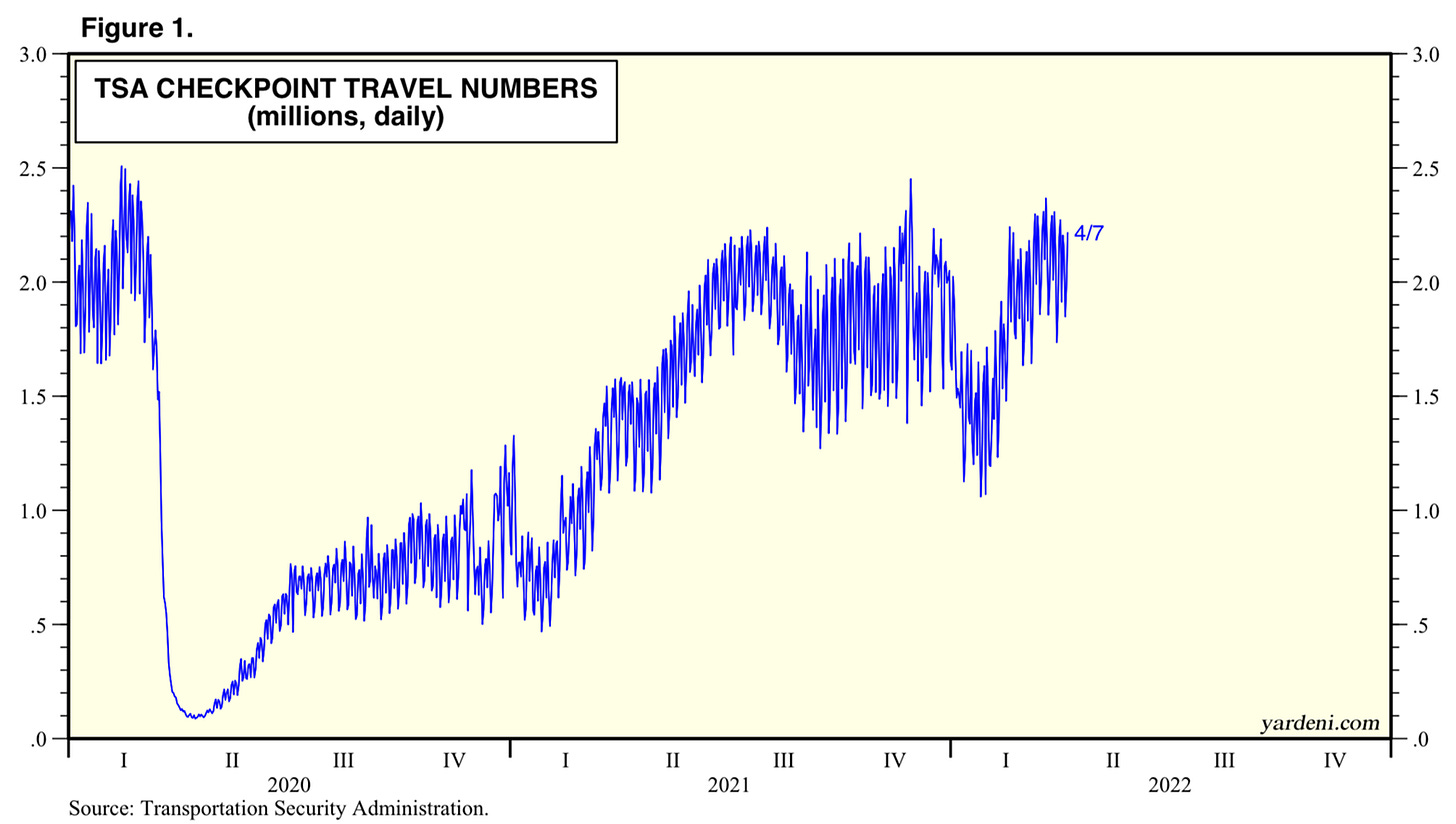

He also points out how spending patterns (decreasing travel habits) have shifted towards purchasing goods which clog up supply chains. As travel increases and concerts begin again we will see a right-sizing of the goods / services balance. Just look at the increase in daily TSA checkpoint figure (the most up-to-date metric) — we’re trending back toward 2019 figures!

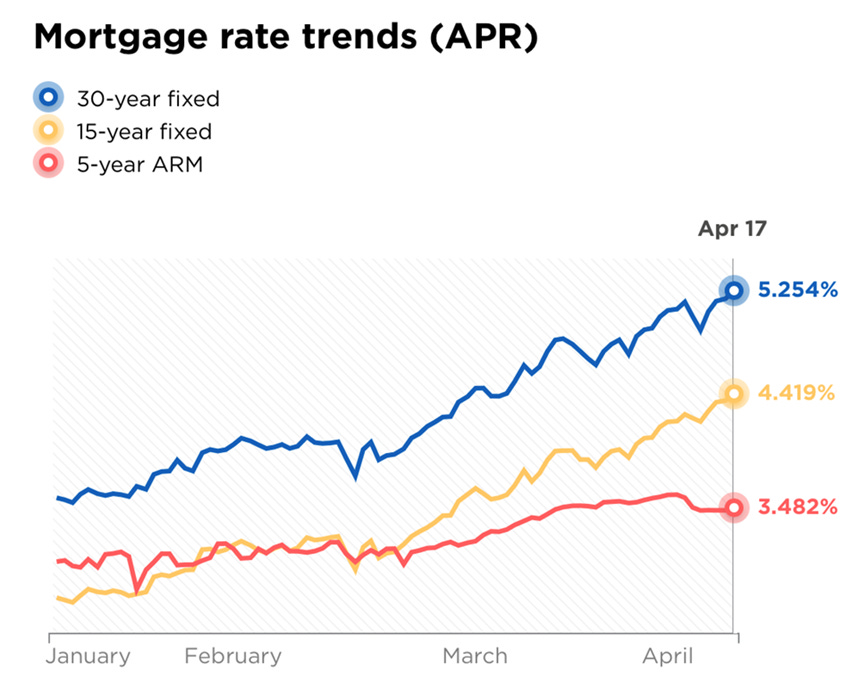

So we’re trending toward more normalized service spending, and congestion at major shipping hubs are easing. Interest rates are rising and mortgage rates are also rising which will slow the rate of new home purchases which will then drive a slow-down in large goods like couches, TVs, and tables. This helps drive down the goods side of the equation.

What about Russia — does that fit the “Transitory” framework?

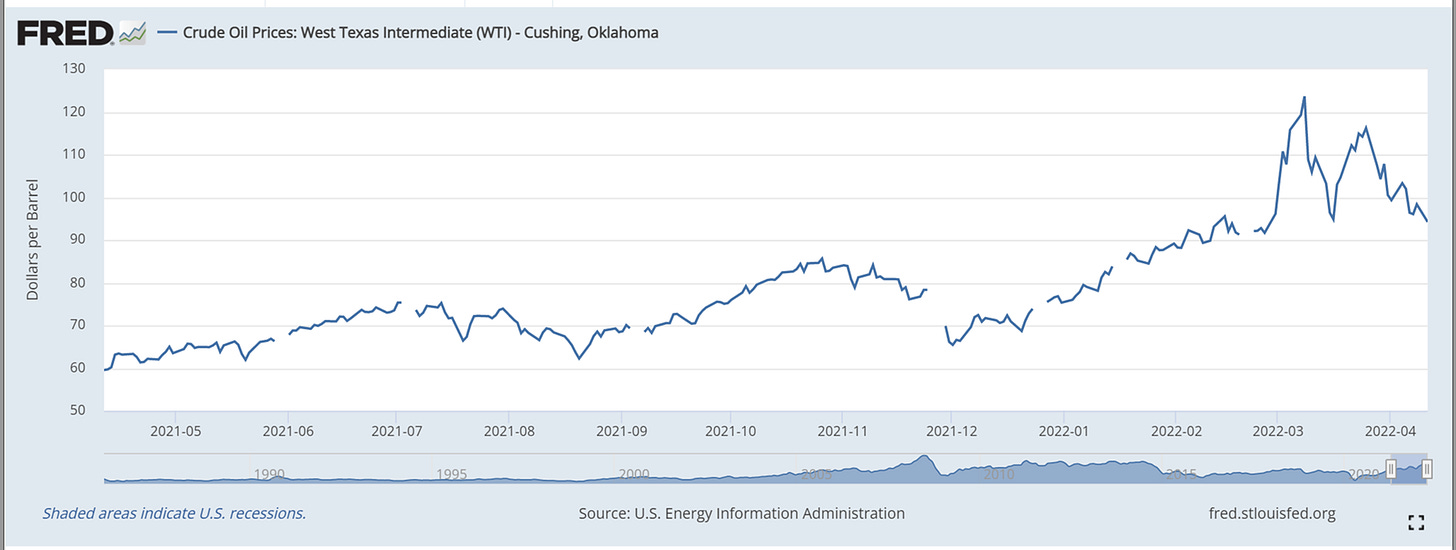

Not exactly – but it can. The crisis in Russia has driven up oil prices due to a general reduction in the quantity of oil available for the US to purchase. The US is right to avoid purchasing Russian oil, it directly funds the war effort and supports the Putin regime. As a pro-democracy force in the world we should be happy that we are able to use economic actions to effectively to work toward crippling a hostile power. Better than boots on the ground.

Yes, actions have consequences. Oil impacts the costs of nearly everything – primarily through its place in the transportation part of the supply chain. When the price of oil goes up, gas prices go up, and then the cost to deliver produce, meat, video games, etc… increase. There are also a litany of other fallouts from the war including fertilizer prices (going to rise due to production in Ukraine / Belarus being less available) and wheat (Ukraine grows a ton of wheat). So by standing up for democracy and engaging in economic warfare we are going to suffer some inflationary pressure on the supply side.

And what’s not to blame?

I think any well-meaning discussion around inflation eventually comes back to the question of who to blame. Up to this point I’ve done my best to identity the mechanical issues with the economy that are leading to higher prices — but everyone wants to use this environment to progress their only policy perspective (present company included) so it’s worth discussing where our fingers should be pointing.

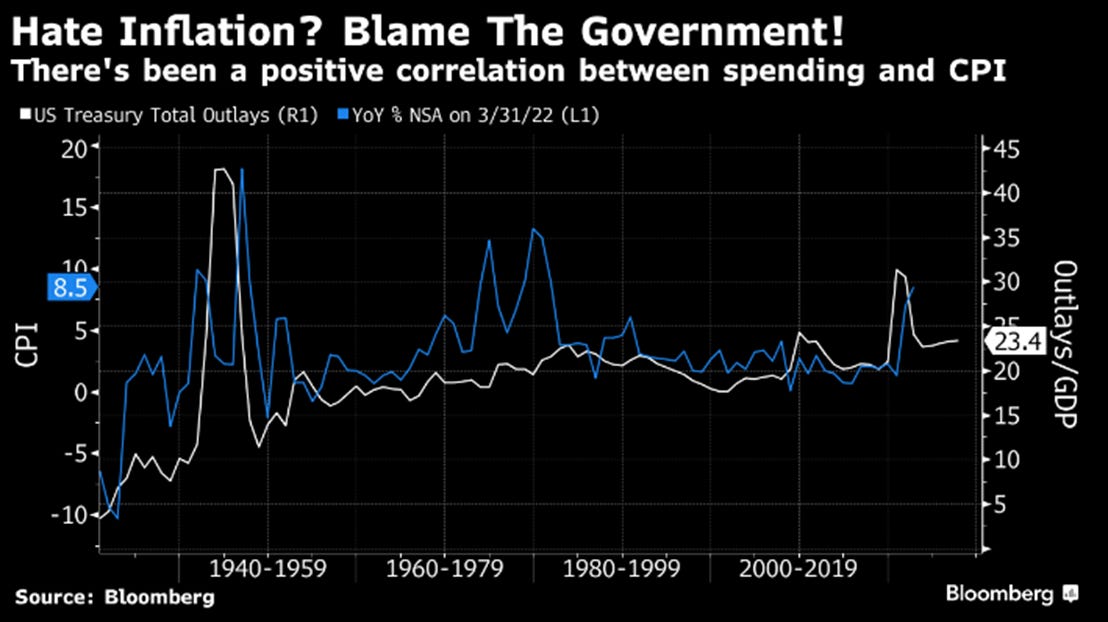

Are politicians to blame? Together, they passed trillions in stimulus which saved millions of Americans from falling deeper into poverty by providing a life vest when it was most needed. It shored up personal balance sheets across the country and created an environment where many Americans were more financially stable than before the pandemic (although, asset price increases have a large role to play there). It is true to say that higher government spending is bound to drive higher inflation, just see the chart below. The government is a buyer of goods and services, so when you encourage it to spend, it will drive higher demand, illustrated below.

That said – a massive take-away from the Global Financial Crisis was that we didn’t spend enough to get America out of the negative credit cycle. In the GFC consumers were heavily over-levered which meant that spending was concentrated in paying down indebtedness rather than stimulating the economy through goods and services spending – meaning that even the most anemic growth wasn’t paying dividends in the figurative sense, but servicing massive credit obligations. I think there’s a matrix of complaints here – but it needs to be balanced. And it’s this difference that really gets at the heart of a lot of the complaints / disagreements about politicians responsibility for inflation.

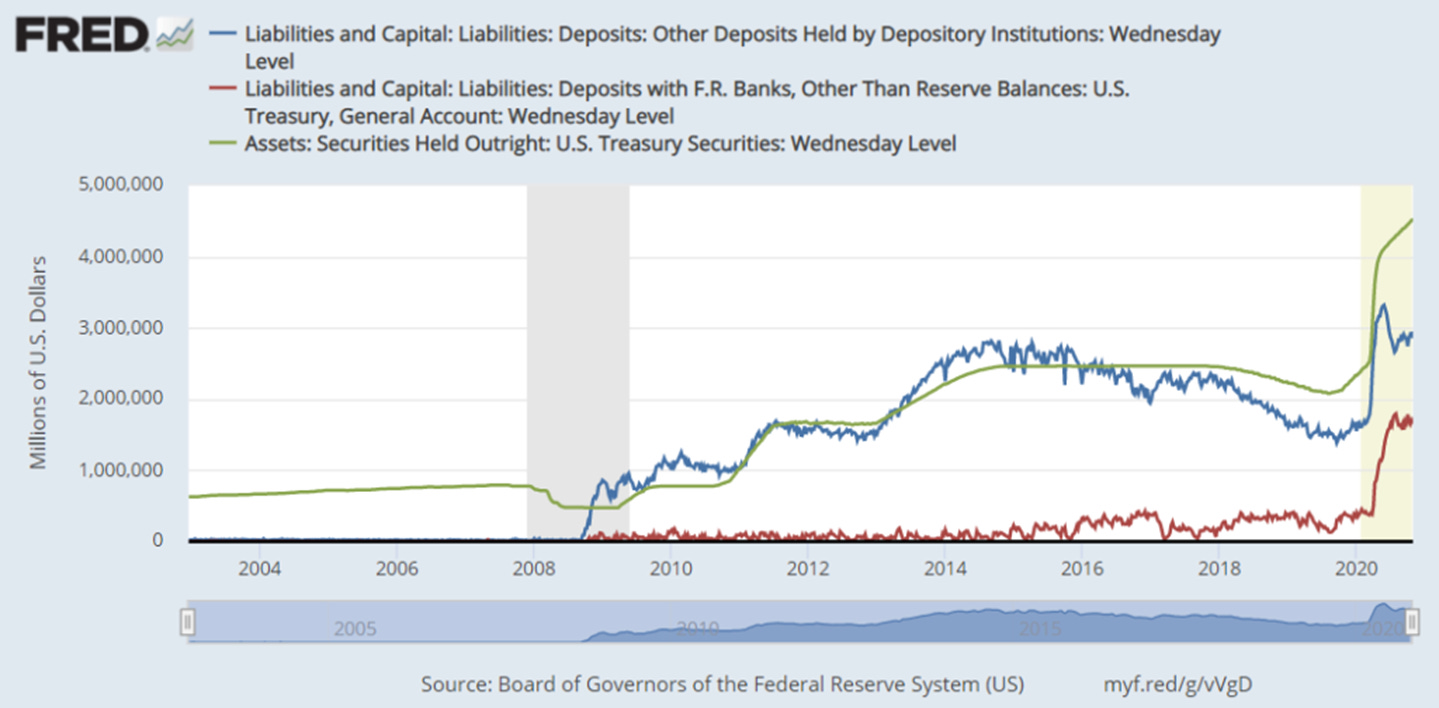

People (even those who should know better) are conflating the above chart (growth in federal spending) and the “printing” the Federal Reserve has engaged in…really since 2009, but definitely since 2020. This is what I hear people nagging about all the time – “the Fed has printed so much money, and that’s driving increased demand” which is pushing up prices. So earlier we discussed how inflation was largely being driven by supply-side constraints, not demand-push – so in my opinion, you can use the Federal Reserve as a complaint – but it’s not the only reason for (or even the primary reason) for inflation. So it’s best to be specific when complaining about politicians / the government’s role in the current crisis. I think the best route to take is to address the specific problems you’d like to see addressed, and not just that “government”.

For example – I’d like the ports (especially along the western seaboard) to increase their operating capacity (why = reduce shipping backlogs). I’d like us to eliminate tariffs on Canadian lumber (why = reduce home building costs). I’d like us to suspend the Jones Act (why = reduce shipping costs). I’d like us to unravel the tariffs with China (why = reduce goods prices). I’d like us to reduce red tape (especially environmental red-tape, like the NEPA) to make it easier to build homes and recued long-term prices. The Biden Administration has the capacity to act on a lot of these right now, and they should! So feel free to go ahead and blame them for that.

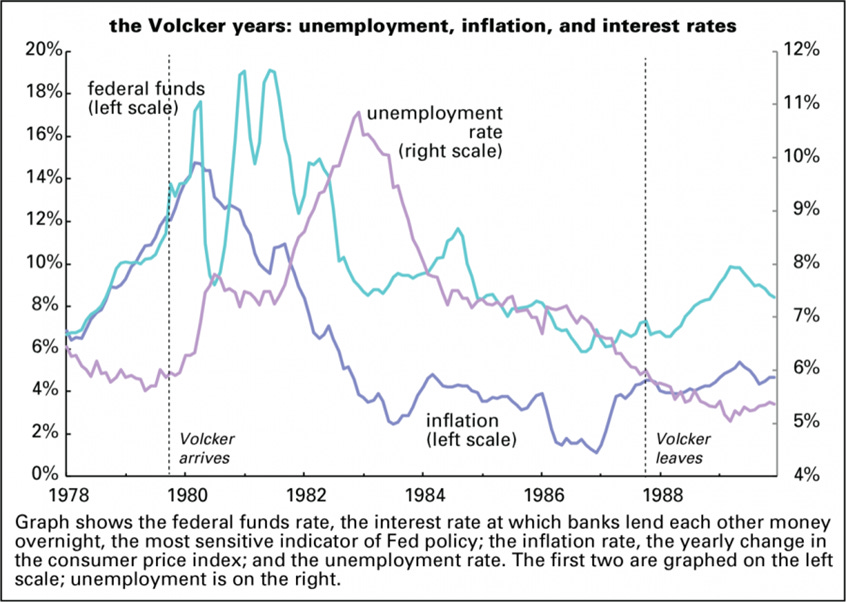

But what I get tired of is people thinking that Republicans are going to handle this any better! They’re not – just straight up. The modern Republican party has become increasingly anti-Free Trade, advocates for NIBYISM, and averse to investments in our national infrastructure. So go ahead complain about the lack of action from the Biden administration – they deserve to be critiqued, but don’t expect me to support Republicans unless you can actually tell me how they’ll fight inflation. Because last time they tried it induced a recession…and I don’t think anybody wants that[2].

I want to caveat this whole post with a quote I read while I was editing (don’t worry – my editing process is basically a re-read / sourcing charts). I don’t think it derails my thesis, but it does add a useful perspective to any discussion. The quote is from Claudia Sahm during an interview with KOA in Colorado:

The question was:

Even if there are signs, and the data shows it’s getting better … Peope don’t feel it psychologically. How do you bridge that gap and tell them it’s better than you feel? … Even though this is tough right now, it’s still better than it could be could be?

And the blunt (her word) response:

I will not tell people how to feel. Everybody looks at the world and they draw their own opinion. I talked with policymakers recently and said very clearly. Yes, many people are back to work which is very different than past recessions. I told them no victory dance. This recovery is halfway done. Policymakers have got to do everything they can to get inflation down.

And maybe that’s a good area of consensus with the inflation doomsayers – we can agree that it’s a problem – but what are your candidates of choice going to do – and how does that differ from the current regime? People should vote for who they believe in for the future – but it’s totally fair and reasonable to ask people to defend their choices if they’re going to attack yours.

I want to thank & apologize to all those who made it this far – it was initially only a 500 word piece, but you know, inflation.

[1] Jesus Duncan, who’s this “us” you’re referring to, you have a BS in Finance, not economics you dud

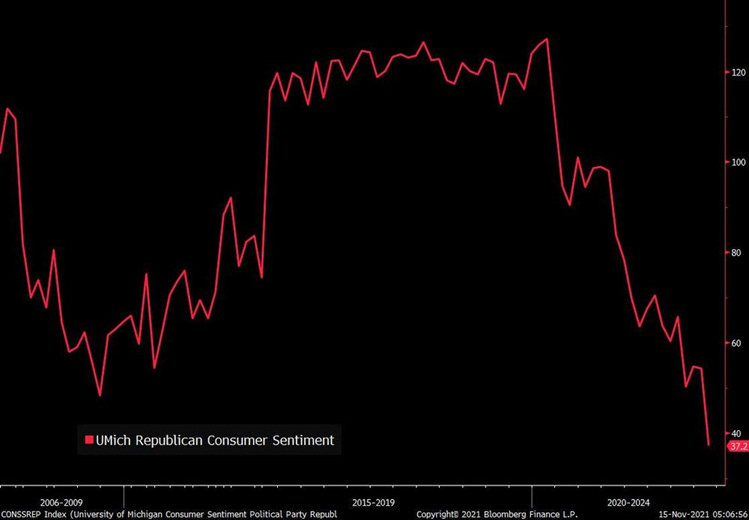

[2] I mean…maybe Republicans do want that. Republican Consumer Sentiment was lower in late 2021 than in the Great Recession…when gas prices were $4+ and unemployment was ravaging the country.